How To Consistently Increase Profits with Profit First

Aug 24, 2023In the dynamic landscape of business, the pursuit of increased profits is a fundamental goal. But what if there was a proven method that not only helps you boost your profits consistently but also transforms the way you manage your finances? Enter the Profit First method – a revolutionary approach that has been transforming businesses worldwide. In this article, we'll delve into how you can effectively implement the Profit First method to consistently increase profits and achieve financial success.

Understanding the Profit First Method:

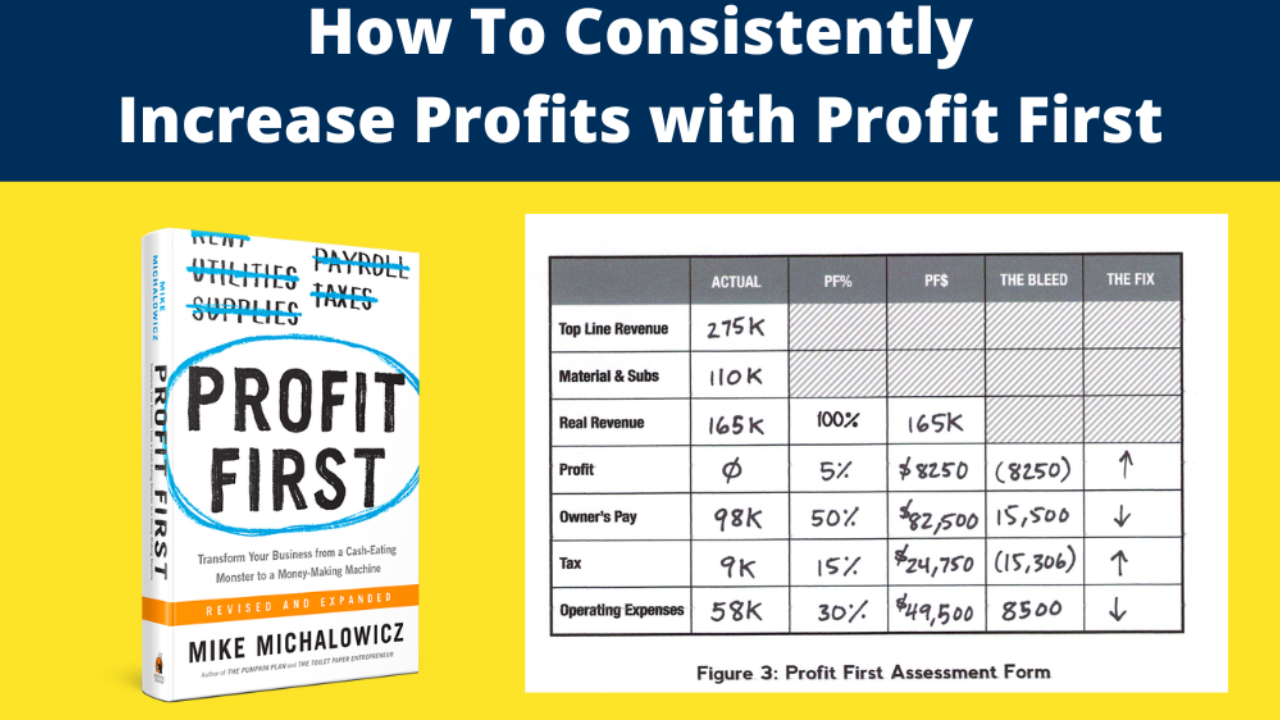

The Profit First method, coined by Mike Michalowicz, challenges the traditional approach of "sales minus expenses equals profit." Instead, it flips the formula to "sales minus profit equals expenses." This seemingly subtle shift in mindset can have a profound impact on how you manage your finances and, ultimately, how you grow your profits.

Benefits of the Profit First Method:

- Consistent Profit Allocation: The Profit First method ensures that you allocate a predetermined percentage of your revenue directly to profit before considering expenses. This guarantees that profits are a priority, not an afterthought.

- Expense Management: By allocating profits first, you're forced to manage your expenses with what's left. This encourages frugality, efficient spending, and a focus on eliminating wastage.

- Financial Clarity: The method prompts you to create separate bank accounts for different purposes – profit, taxes, operating expenses, etc. This provides a clear visual of your financial health and prevents "robbing Peter to pay Paul."

- Cash Flow Optimization: With a focus on consistent profit allocation, you're better equipped to handle cash flow fluctuations and unexpected expenses, ensuring stability even during challenging times.

- Sustainable Growth: By consistently increasing profits, you're not just looking at short-term gains but building a solid foundation for sustainable business growth.

Implementing Profit First:

- Assessment: Analyze your current financials to determine your baseline profit percentage.

- Allocation: Set up separate bank accounts for profit, taxes, operating expenses, and other specific purposes.

- Consistency: Stick to the predetermined allocation percentages and adjust as your revenue grows.

- Regular Check-ins: Regularly review your financials and adjust allocations to align with your goals.

In the pursuit of increased profits, the Profit First method offers a game-changing approach that ensures financial stability, efficient expense management, and consistent growth. By prioritizing profits, managing expenses effectively, and optimizing your cash flow, you'll be well on your way to not only increasing profits but also achieving sustainable success.

Leave a reply

We hate SPAM. We will never sell your information, for any reason.