Financial "Cents"

Join us on March 13th to learn more about Understanding Your Personal Taxes (as a Business Owner) with Tim Kenny.

Tax rules are complicated, but taking some time to plan with your accountant will allow you to understand how to use them for your benefit and change how much you end up paying...

FEBRUARY

The Lowdown on Organizing Your Tax Documents

It's that time of the year again – tax season. Now, before you break into a cold sweat or start contemplating faking your own disappearance, let's talk about the move that will save you from the tax season chaos: organizing your tax...

January's Financial Framework

To do: Set two doable financial goals, either for the year, or for each month of the year.

To pay: The previous year’s fourth quarter estimated tax payment is due by January 15th.

Important Financial Dates

January 1

- Bank Holiday (New Year's Day)

- 2024 Social...

DECEMBER NEWSLETTER

Title: "Unlocking Generosity: The Power of Gift and Estate Giving in Reducing Tax Liability"

Introduction:

In the realm of financial planning, there exists a powerful avenue for both philanthropy and strategic wealth management – gift and estate giving. Beyond the...

Introduction:

As the year draws to a close, there's a unique window of opportunity to take charge of your financial destiny. Year-end financial planning is not just a ritual; it's a strategic move that can significantly impact your tax liability and set the stage for a more prosperous future. In...

In the dynamic world of business, where transactions flow in and out like the tide, there exists a financial pulse that determines the vitality of any enterprise - cash flow. The movement of money in and out of a company over a specific period, cash flow is the heartbeat that sustains operational...

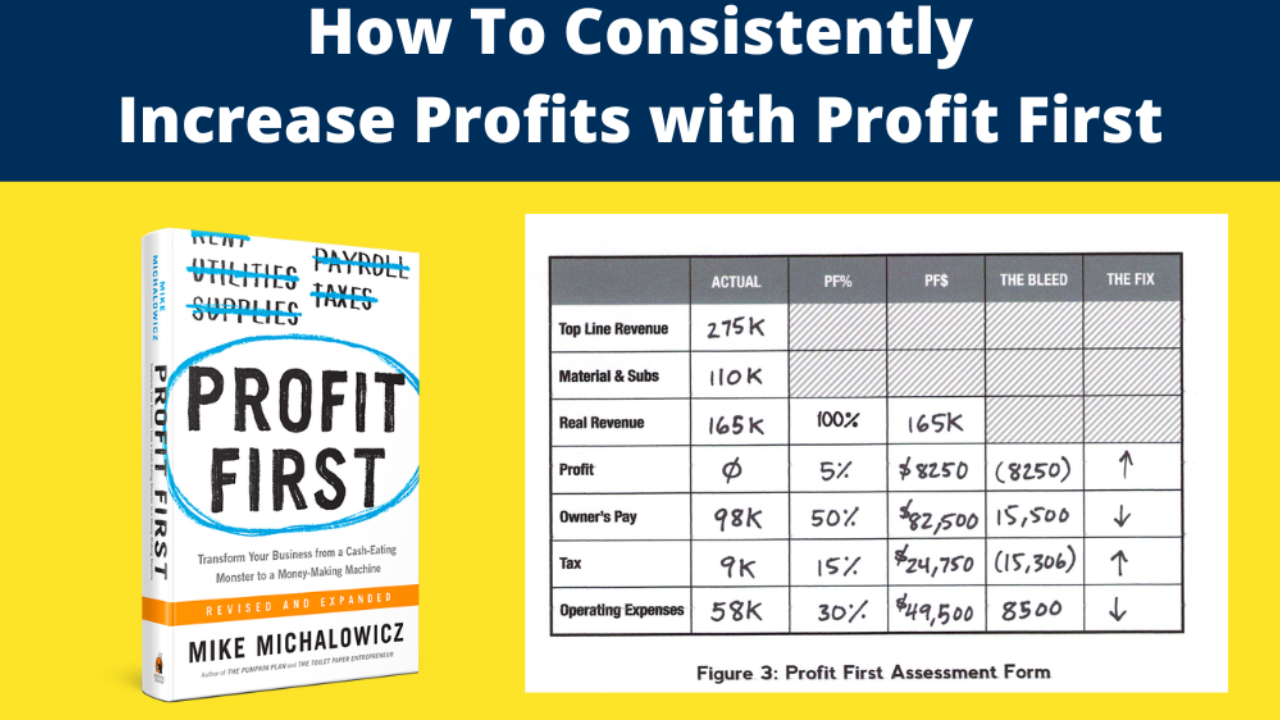

In the dynamic landscape of business, the pursuit of increased profits is a fundamental goal. But what if there was a proven method that not only helps you boost your profits consistently but also transforms the way you manage your finances? Enter the Profit First method – a revolutionary...

In today's fast-paced world, the pursuit of productivity is paramount for individuals and businesses alike. But what if we told you that the key to unlocking your peak productivity lies not just in time management techniques, but in harnessing the power of Positive Intelligence? In this article,...

As a business owner, you understand that taxes are a significant aspect of running a successful enterprise. However, navigating the complex world of taxation can be overwhelming and time-consuming. That's where Kenny & Kenny P.C. comes in. Our expert team is dedicated to helping businesses...

Unlock the Benefits of the Financial Foundations Bootcamp

Free yourself up to begin enjoying the rewards of owning a business:

The Financial Foundations Bootcamp empowers you to focus on what truly matters to you by providing you with the knowledge and tools to streamline your financial processes...

Are you looking for ways to minimize your tax burden while maximizing savings for your business?

Effective tax planning is a crucial component of financial success. By implementing smart strategies and staying informed about tax-saving opportunities, you can unlock significant financial benefits...

Are you struggling to find the right pricing strategy for your products and services? Pricing plays a crucial role in shaping your business model and directly impacts your profitability and growth. In this blog post, we will explore the significance of pricing products and services effectively...